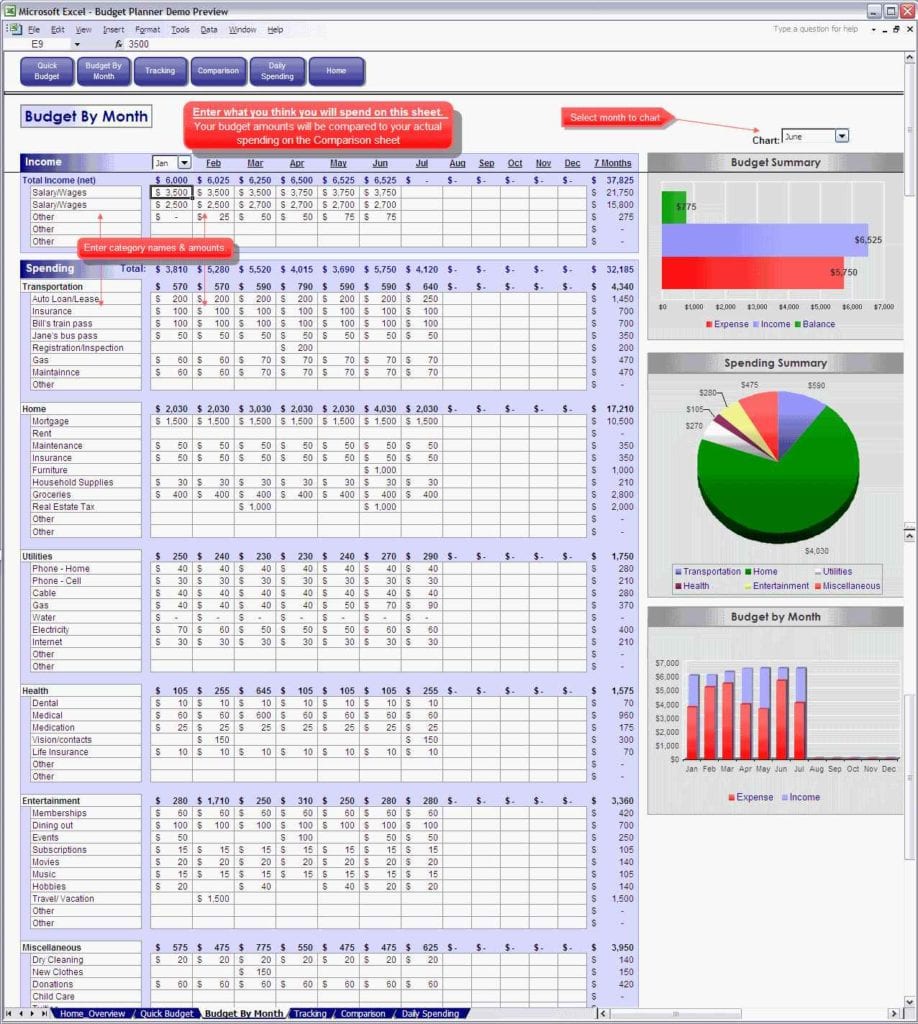

What if you don’t really know how much you spend? No worries, just use your transaction history and bank statements to make your best guess for any expenses you’re not sure about. Use the “Leftover Income To Budget” box at the bottom of the template to see how much of your total cash you haven’t yet allocated to a budget category (make sure you’re using all of your income!).Track your actual spending throughout the month in the “Spent” column.Add any categories we missed in the “Other” rows.

Fill in the blanks for your monthly expenses by putting your typical costs in the “Budgeted” column for each category.Enter your monthly income (after taxes) at the top of the template.How to create your personal monthly budget template Now that you know how a 50/30/20 budget works, the next step is to personalize the budget template. This can be a helpful perspective if you’ve ever found budgeting to be too restrictive. By breaking your total income down into categories, you’re telling yourself how much you can spend in each category - not focusing on what you shouldn’t spend. You can think of your budget as a spending plan.

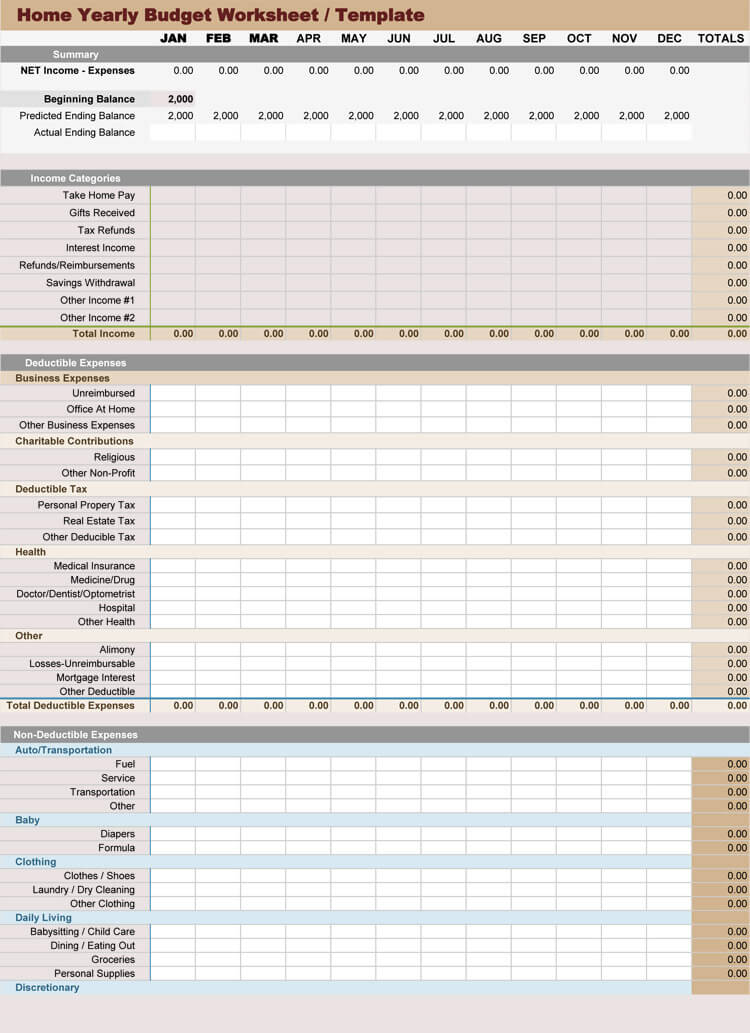

This includes putting money into your emergency fund, investing in retirement accounts, and saving for big financial goals - like the down payment on a car or house. This includes the things you do for fun, such as going to concerts or dining out, and other things that are important to you, like updating your seasonal wardrobe or donating to charity.

This includes household expenses that may fluctuate (think: groceries and utilities) as well as fixed costs, like insurance premiums or car payments, and other non-negotiables. Then, it gives a different percentage of your income to each of these expense categories. This is a widely used strategy that’s easy to apply and remember.īasically, it helps you set priorities in your budget and categorize expenses by breaking your spending into three types: needs, wants, and savings. This template follows the 50/30/20 budgeting method.

0 kommentar(er)

0 kommentar(er)